Over the past weeks, the world has been hit with terrifying news, a viral outbreak has inflected almost 25,000 people, killing at least 490 people. The United States imposed travel restrictions on movements to and from China, and even China has closed transportation of Wuhan, a city of 11 million people. For comparison, consider the population size of New York City or London, then add an additional 20% to that figure, and you will have a better understanding of the magnitude of the lockdown occurring in China. Even if you have little understanding of various viruses and their potential threats on a person’s health, just knowing that an order as huge as shutting down a city of that size has been executed is enough to take the threat of the coronavirus very seriously.

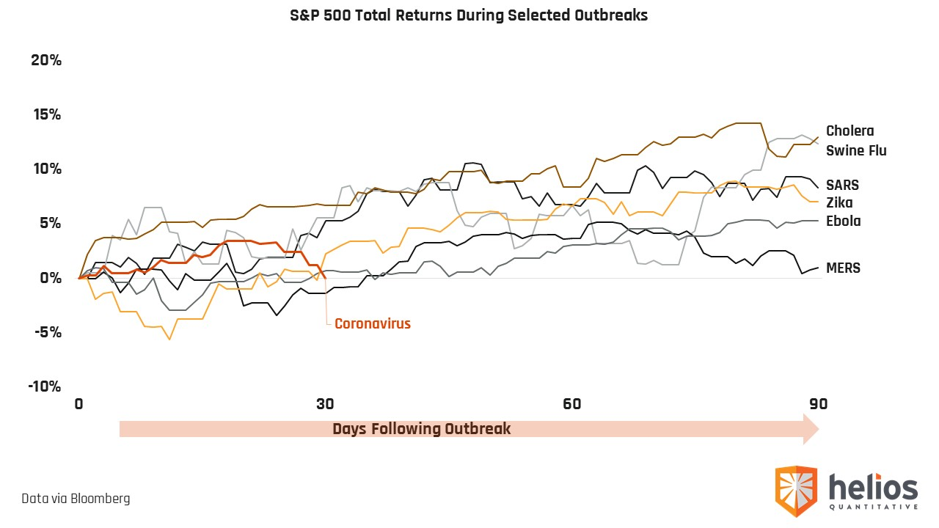

Globalization has not only intertwined economics, but health, communication, travel, culture, and many other facets of everyday life. Therefore, when it comes to emotional investing, you would be hard-pressed to find a more compelling example than the potential of a deadly virus spreading from one corner of the world to another. Many investors will quickly lose sight of the importance of long-term investing, and instead will worry about the short term impact of such a viral outbreak. While the short-term implications can quickly lead our imaginations down a slippery slope, a quick glance at the previous outbreaks of the 21st century can provide a helpful reference point.

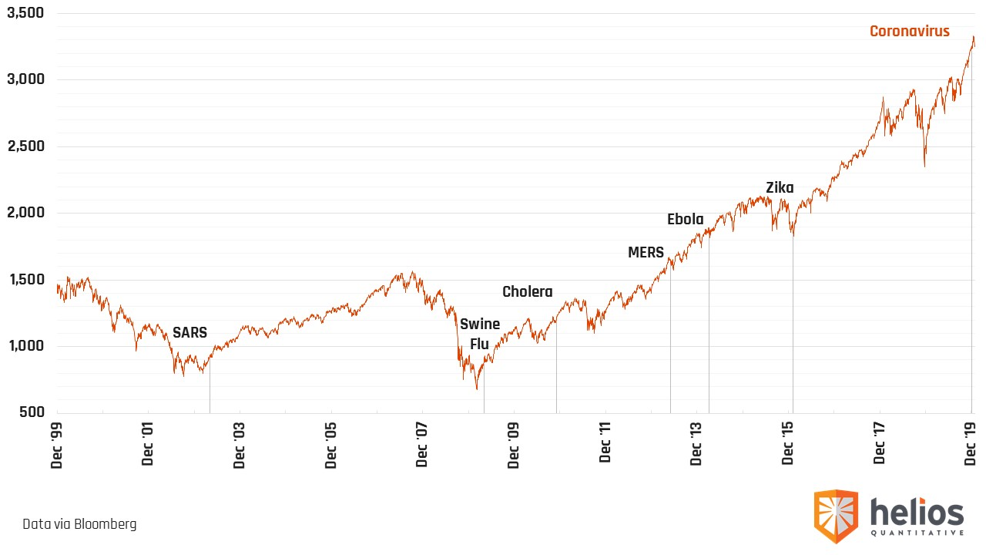

The chart below shows the S&P 500 with a mark designating the first report of each major outbreak. Although each outbreak was very serious, the impact on large companies in aggregate has not proven to be negative. Furthermore, attempting to sidestep an outbreak by selling stocks and waiting for a selloff to reenter the market has been an even more challenging endeavor as the selloffs tend to be quick and short-lived.

If you were to expand your view past 90 days following the first reported case of a virus, there is even more historical evidence that attempting to time the market based on fears of a viral contagion has not been a successful strategy.

Of course, past performance does not indicate future results, and although previous outbreaks weren’t able to stagnate forward returns of the stock market, it doesn’t mean that they are not capable of doing so. However, simply looking at the headline is not how to invest during times like these. The important information to pay attention to is the data sets you predetermine to be the most valuable to your decision-making process.

If you do a quick google search for any economists’ 2020 market outlook, you are not going to see “viral outbreak” as an input on any of their dashboards. It’s not easy to operate in a world where information is distributed in real-time from one portion of the globe to another, and creating a rules-based system gives us the tools to focus on what matters most.

Sources:

Helios Quantitative

Bloomberg

Coronavirus Global Cases https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss.