Quarterly Market Update for Q2 2025: Tariffs, Geopolitics, and All-Time Highs

The second quarter of 2025 showcased both the resilience of financial markets and their sensitivity to policy uncertainty. From the White House’s tariff announcements in April to escalating tensions between Israel and Iran in June, investors faced many challenges. Yet, the stock market went on to stage one of the fastest rebounds in history and […]

New Market All-Time Highs: How Investors Can Stay Balanced

President Dwight Eisenhower is often quoted as saying “what is important is seldom urgent and what is urgent is seldom important.” This perfectly captures the challenges many investors face, since it often feels as if every breaking market and economic development is urgent and requires immediate action. That has certainly been the case this year […]

Introduction to the Different Investment Vehicles

When it comes to building wealth and planning for your financial future, investing plays a critical role. But with so many options available, navigating the world of investments can feel overwhelming. That’s where understanding investment vehicles comes in. Investment vehicles are the tools or methods you use seeking to grow your money. They range from […]

Cleaning Up Your Financial Records for Due Diligence

When you’re preparing to sell your business or seeking investment, getting your financial house in order is crucial. A thorough due diligence process is inevitable, and clean, accurate financial records can make or break a deal. Let’s walk through the key steps to ensure your financial records are in top shape for due diligence. […]

The Middle East Conflict: How Wars Impact Investors

The conflict between Israel and Iran has captured global attention and created uncertainty in financial markets. Israeli strikes on Iranian nuclear facilities and military targets began on June 13 and quickly led to retaliatory attacks. Then, on June 21, the U.S. launched strikes on Iran’s nuclear facilities. The situation is still evolving and can change […]

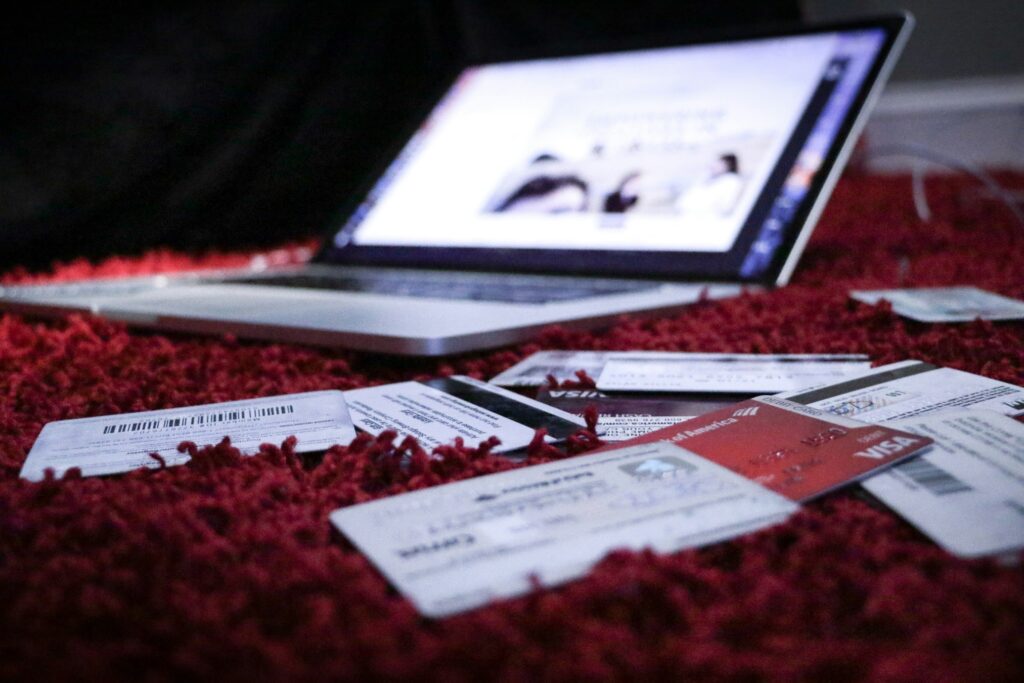

Understanding Credit Scores and Credit Reports

Your credit score isn’t just a number—it’s a key to unlocking financial opportunities. Whether you’re applying for a loan, renting an apartment, or even job hunting, your credit score and credit report play a crucial role in your financial journey. The better you understand them, the more control you have over your financial future. […]

Understanding and Improving Your Business’s Cash Flow

Cash flow is often described as the lifeblood of a business, and for good reason. It’s not just about profitability; it’s about having the liquid assets to keep your operations running smoothly day-to-day. Let’s dive into what cash flow really means and how you can improve it to ensure your business thrives. What Is […]

Monthly Market Update – May 2025: A Positive Month Despite U.S. Debt Downgrade

Financial markets rebounded in May with the S&P 500 recovering its year-to-date losses. This positive month occurred against a backdrop of new trade agreements, mixed economic signals, and ongoing concerns about U.S. fiscal health. While many reports continued to show that the economy is strong, consumers remained pessimistic about the future. Treasury yields fluctuated throughout […]

Chart Book-May 2025

Strategies for Paying Off Debt

Paying off debt can feel overwhelming, but with the right strategy, you can take control of your finances and work toward a debt-free future. Whether you’re tackling credit card balances, student loans, or other financial obligations, having a clear plan will help you stay focused and motivated. Here are some effective strategies to accelerate your […]