Go to the Head of the Class

Master these Social Security lessons to get a more realistic view of your retirement. According to Nationwide’s 8th Annual Social Security Consumer Survey, more than half of Americans express confidence that they know exactly how to optimize their Social Security benefits. However, only 6% actually understand all the factors that determine the maximum benefit someone […]

Caring For Aging Parents

Many adults have aging parents who are in need of living and health care assistance. There are a number of resources today that can help them grow old gracefully, either in their existing home or in a facility, along with multiple options for financing the cost of the care. Living options Living alone: Depending on the […]

MAKING SENSE OF MEDICARE PARTS A, B, C, AND D

With its four distinct parts, Medicare can be an alphabet soup of complexity. We provide an overview of the various components and how they impact your healthcare costs. Medicare is available to virtually all U.S. citizens and legal residents 65 years of age and over who have previously worked and paid U.S. taxes or who […]

The Basics of Financial Fitness

Becoming financially fit requires maintaining foundational elements, including a budget, emergency fund, strong credit score, and retirement savings. There’s a subjective uncertainty associated with financial wellness. Are you financially fit? And if so, how fit are you? While there is no clearly defined threshold for answering affirmatively, much less grading your level of fitness, there […]

Medicare Options During Retirement

Americans 65 years of age and older face a number of choices when it comes to Medicare healthcare coverage. We look at the top considerations. Medicare is available to virtually all U.S. citizens and legal residents 65 years of age and over who have previously worked and paid U.S. taxes or who are/were married to […]

February Webinars

Don’t miss our February webinars: DIGITAL SCAMS & HOW TO PROTECT YOURSELF – RECORDED February 18th at 3:30 CST – WATCH THE RECORDING OF THE WEBINAR 2021 MARKET OUTLOOK – RECORDED February 4th at 3:30 CST – WATCH THE RECORDING OF THE WEBINAR

4 Financial Planning Strategies during a Market Downturn

During periods of market volatility, it is very normal to pay close attention to your portfolio while putting other aspects of your financial life on hold. However, there are many important planning items that should not be overlooked during these times. Here are a four planning ideas that can be implemented during market downturns that […]

3 Wealth Transfer Strategies to Help with Changes to the “Stretch IRA”

Since the passing of the SECURE Act, many account holders of IRAs are concerned for the tax burden on their heirs since the abandonment of the so-called “Stretch IRA.” Below we highlight 3 potential wealth transfer planning opportunities that we may discuss with our clients: Life Insurance Due to the loss of the ‘stretch’, it […]

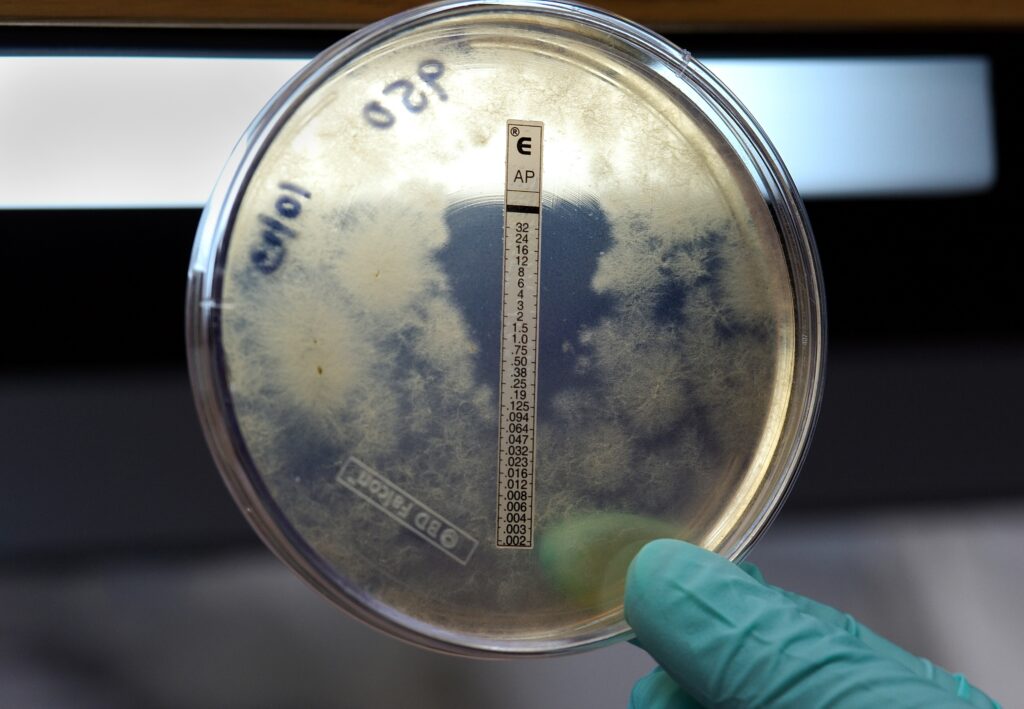

Investing During An Outbreak

Over the past weeks, the world has been hit with terrifying news, a viral outbreak has inflected almost 25,000 people, killing at least 490 people. The United States imposed travel restrictions on movements to and from China, and even China has closed transportation of Wuhan, a city of 11 million people. For comparison, consider the […]

The SECURE Act: What It Is and How It Will Impact Retirement

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, includes many bi-partisan reforms that increase access to workplace plans and expand retirement savings. The retirement legislation includes policy changes that will impact defined contribution (DC) plans, defined benefit (DB) plans, individual retirement accounts (IRAs) and 529 plans. Below are two […]